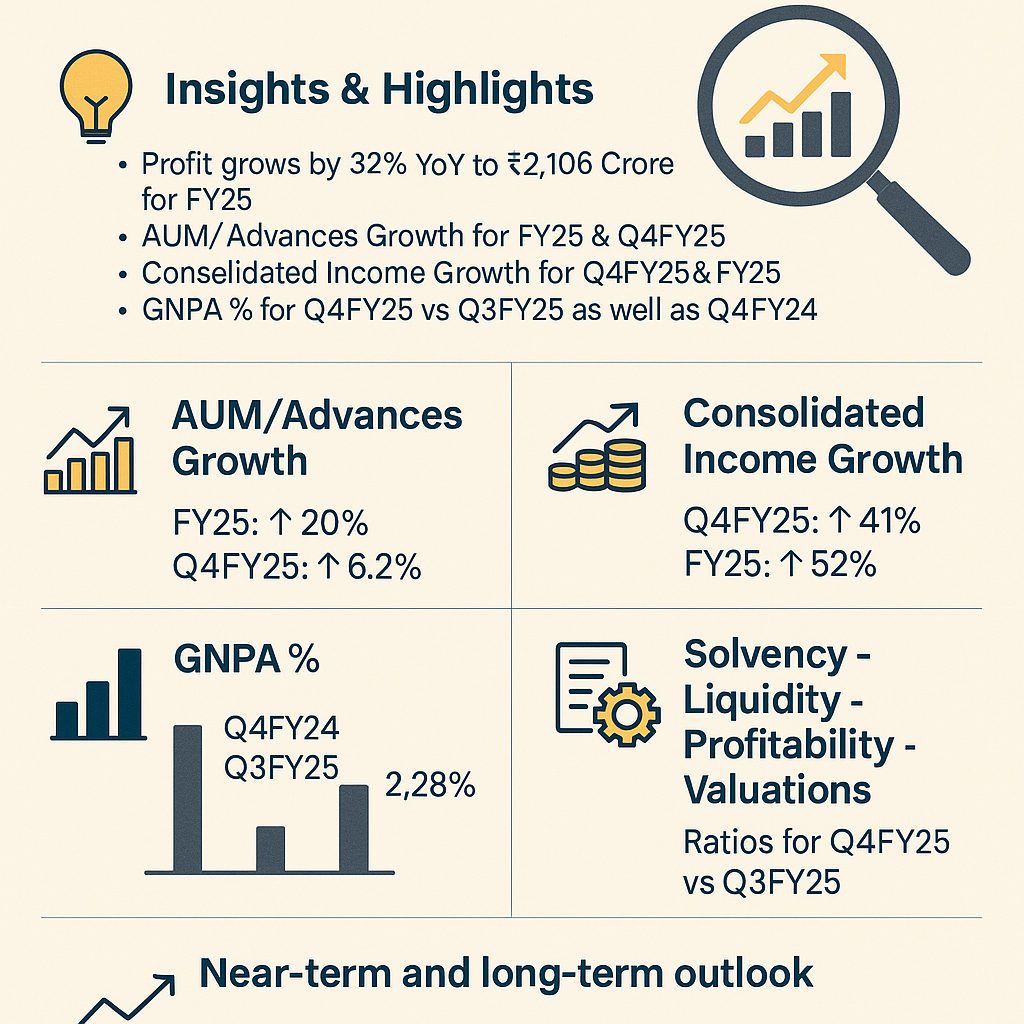

📊 AU Small Finance Bank Q4 & FY25 Results – Growth Anchored by Profitability & Prudent Risk Management

Date: 22nd April 2025

CMP: ₹613 | Market Cap Leader in Small Finance Banking

🏦 Key Financial Highlights

🔹 AUM/Advances Growth

Gross Loan Portfolio grew to ₹1,15,704 Cr (20% YoY | 6.2% QoQ).

Secured Portfolio (Retail + Commercial) expanded 25.3% YoY and 8.1% QoQ.

Unsecured Portfolio contracted by 17.6% YoY, reflecting conservative asset quality focus amidst sector-wide deleveraging.

🔹 Consolidated Income Growth

Net Interest Income (NII) surged by 55% YoY to ₹8,012 Cr in FY25 and by 57% YoY in Q4 to ₹2,094 Cr.

Other Income rose by 49% YoY in FY25 to ₹2,526 Cr and by 41% YoY in Q4 to ₹761 Cr.

Total Income for FY25 reached ₹18,590 Cr, up 52% YoY.

🔹 Profit Performance

FY25 PAT: ₹2,106 Cr (32% YoY growth)

Q4FY25 PAT: ₹504 Cr (18% YoY growth)

EPS: ₹28 for FY25 (up 19% YoY)

Book Value Per Share: ₹231 (up 23% YoY)

📉 Asset Quality Snapshot

The bank demonstrated prudent provisioning with an additional ₹150 Cr set aside in Q4FY25 to further strengthen buffers, primarily for unsecured exposures.

📌 Key Operating Metrics

NIM: 5.94% for FY25 vs. 5.45% in FY24 | Q4 NIM at 5.8%

RoA: 1.5% for FY25 | Q4 RoA at 1.4%

RoE: 13.1% for FY25 | Q4 RoE at 11.9%

Cost to Income Ratio: Improved to 57% in FY25 (vs. 64% in FY24) | Q4 at 55%

Liquidity Coverage Ratio (LCR): Healthy at 116%

🧮 Solvency, Liquidity, Profitability & Valuations (CMP ₹613)

🌐 Industry KPIs vs. AU Bank Performance

AU Bank’s high RoA model and leaner operations are positioning it above the peer average in profitability, despite macro headwinds.

🔭 Outlook: Near Term & Long Term

Near-Term View (FY26):

Margins may moderate slightly due to rising cost of funds.

Risk-controlled growth likely in secured books.

Further integration of Fincare business to add scale with cost synergies.

Long-Term View (Vision 2027):

Strategic portfolio shift towards high-RoA segments to continue (~73% already achieved).

Digital innovation (AU Ivy, AU Eternity, AU Udyogini) to enhance cross-sell and fee income.

AU Bank is building resilience with a strong capital base, diversified product suite, and robust liquidity management.

📝 Disclosure

This blog post is for informational purposes only. It does not constitute investment advice or a recommendation. Investors must exercise their own judgment before investing. AU Bank's performance data are derived from publicly available documents including investor presentations, press releases, and financial results.