🔬 PI Industries Ltd – Q4 & FY25 Results Review | Growth, Margins, and Outlook

📅 Report Period: Q4 FY25 & FY25

📈 CMP: ₹3,688

🏢 Industry: Agrochemicals & Life Sciences

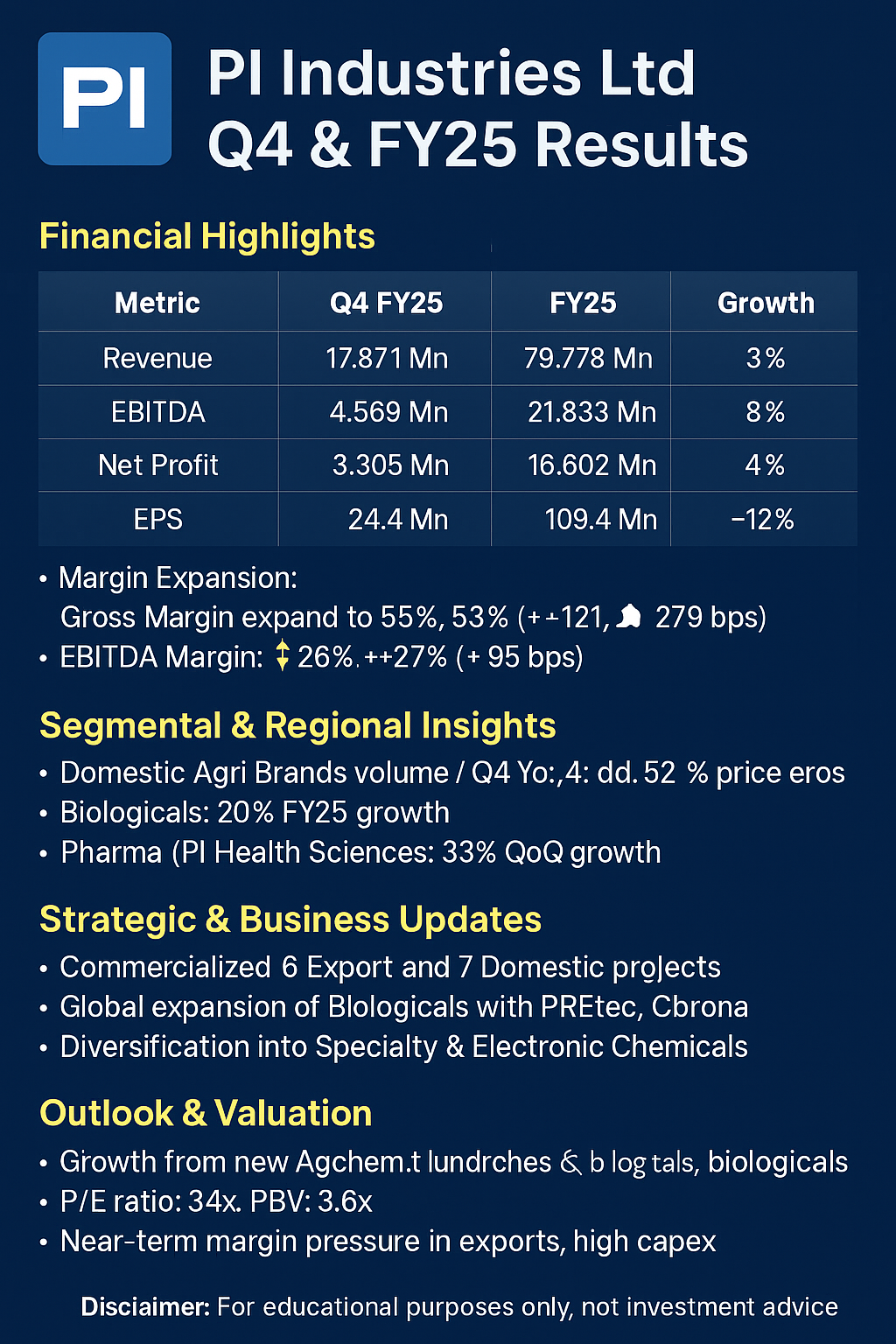

📊 Financial Highlights

Consolidated Income Statement Summary:

🚀 Segmental & Regional Insights

Domestic Agri Brands:

Q4: +21% YoY (Volume +24%)

FY25: +6% YoY (Volume +9%)

Strong growth due to good Rabi season and new launches

Agchem Exports:

Q4: -5% (Volume +7%)

FY25: +5% YoY (New product contribution +31%)

Price erosion due to softening input costs

Biologicals:

Q4: +10% YoY

FY25: +20% YoY

Strong traction with sustainable agri solutions

Pharma (PI Health Sciences):

Q4: 6% of exports revenue

33% QoQ growth

📈 Key Financial Ratios (Consolidated)

💰 Cash Flow Snapshot

📉 FCF decline driven by higher capex for new capacity and R&D expansion.

🧪 Strategic & Business Updates

6 new products commercialized in Exports, 7 in Domestic Agri

Biologicals: Global expansion plan with PREtec, Obrona, Saori, and Teikko in portfolio

Diversification into Specialty & Electronic Chemicals

Strong engagement via 15,000+ distributors and 1.6 Mn farmers

🔭 Outlook & Valuation

Valuation Ratios (CMP ₹3,688):

PE Ratio: ~33.7x

PBV: ~3.6x

Near-term growth supported by:

Continued biologicals expansion

New launches in Agchem and Pharma

Strengthened India distribution

Challenges: Margin pressure in exports, high capex impacting cash

📌 Investor View

🔷 Long-term outlook remains promising, supported by diversified growth engines

🔷 Near-term volatility in profitability due to high tax and input price dynamics

🔷 Investors may accumulate on dips with a 5-year horizon

⚠️ Disclaimer

This analysis is for educational purposes only and should not be construed as investment advice. Investors are advised to do their own due diligence before making any investment decisions.