📘 Bajaj Auto May 2025 Sales Update & Cash Flow Insights: What It Means for Q1 FY25

🚦 Sales Performance: A Quick Recap (May 2025 vs May 2024)

| Segment | May 2025 | May 2024 | YoY Growth (%) |

|---|---|---|---|

| 🏍️ 2-Wheelers – Domestic | 1,91,412 | 1,88,340 | +2% |

| 🌍 2-Wheelers – Exports | 1,40,958 | 1,17,142 | +20% |

| 🚛 Commercial Vehicles – Domestic | 34,321 | 36,747 | -7% |

| 🌐 Commercial Vehicles – Exports | 17,930 | 13,094 | +37% |

| 📦 Total Vehicles Sold | 3,84,621 | 3,55,323 | +8% |

📊 Year-to-Date (Apr–May 2025)

| Segment | Apr–May 2025 | Apr–May 2024 | YoY Growth (%) |

|---|---|---|---|

| 🏍️ 2-Wheelers – Domestic | 3,80,027 | 4,05,290 | -6% |

| 🌍 2-Wheelers – Exports | 2,70,280 | 2,41,981 | +12% |

| 🚛 Commercial Vehicles – Domestic | 66,321 | 68,880 | -4% |

| 🌐 Commercial Vehicles – Exports | 33,803 | 27,428 | +23% |

| 📦 Total Vehicles Sold | 7,50,431 | 7,43,579 | +1% |

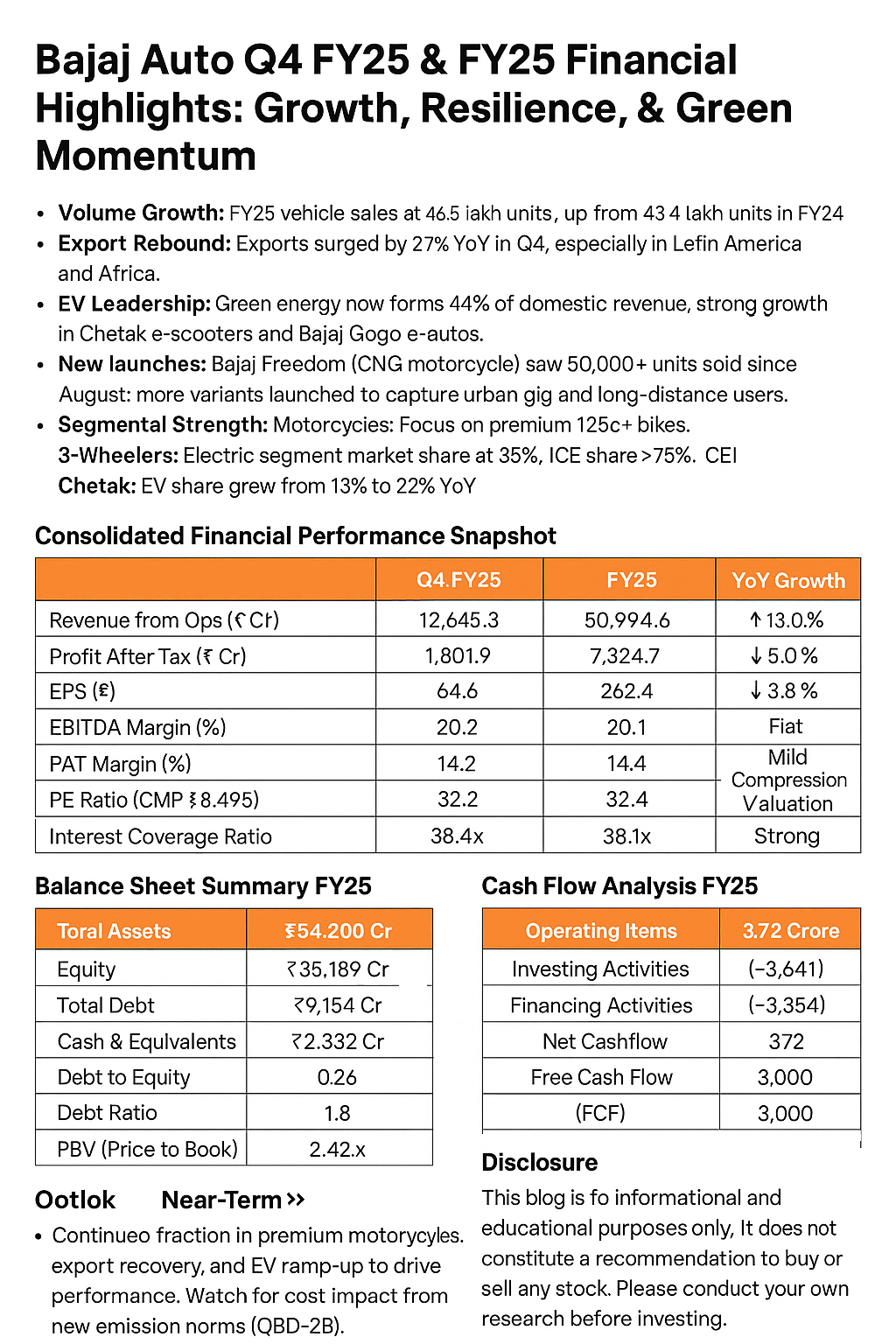

🧾 Cash Flow Health Check: FY24 to Q1 FY25 Implication

🔍 Based on Bajaj Auto’s latest available consolidated cash flow statement (FY24 or Q4 FY24):

| Cash Flow Metric | Value (₹ Cr)* |

|---|---|

| Cash Flow from Operations | ✅ Positive |

| Cash Flow from Investing | ❌ High Outflow |

| Cash Flow from Financing | ❌ Outflow (Dividend, Buyback) |

| 🔻 Net Cash Flow | Negative |

| 🔻 Free Cash Flow (FCF) | Negative |

*approximate values based on the latest available statements

🧠 Interpretation:

Despite operational profits, heavy capital expenditure and cash outgo (likely toward product development, capacity expansion, or dividends) have resulted in negative Free Cash Flow. This signals short-term liquidity strain — a critical insight for long-term investors.

📉 Q1 FY25 Outlook: A Balanced View

✅ Positives:

Strong export performance could continue to drive revenues.

Potential margin improvement from premium product mix.

⚠️ Concerns:

Domestic demand weakness is a red flag for volume-led growth.

Negative Free Cash Flow could limit expansion flexibility or impact cash reserves.

🔮 Overall Sentiment:

Cautiously Optimistic — growth exists, but liquidity and domestic momentum need close tracking in Q1 FY25.

📌 Conclusion

Bajaj Auto is navigating a mixed terrain: exports are delivering but domestic and cash flow indicators signal the need for caution. Investors should monitor upcoming Q1 results not just for profit growth, but for sustainability of cash flow and capex strategies.

📄 Disclaimer:

This blog is intended solely for educational purposes. It is not investment advice. Data used is sourced from company filings and public disclosures. Investors