🌿 Patanjali Foods Q4 & FY25 Results: 70% PAT Growth | HPC Integration Powers Diversification

📌 Executive Summary

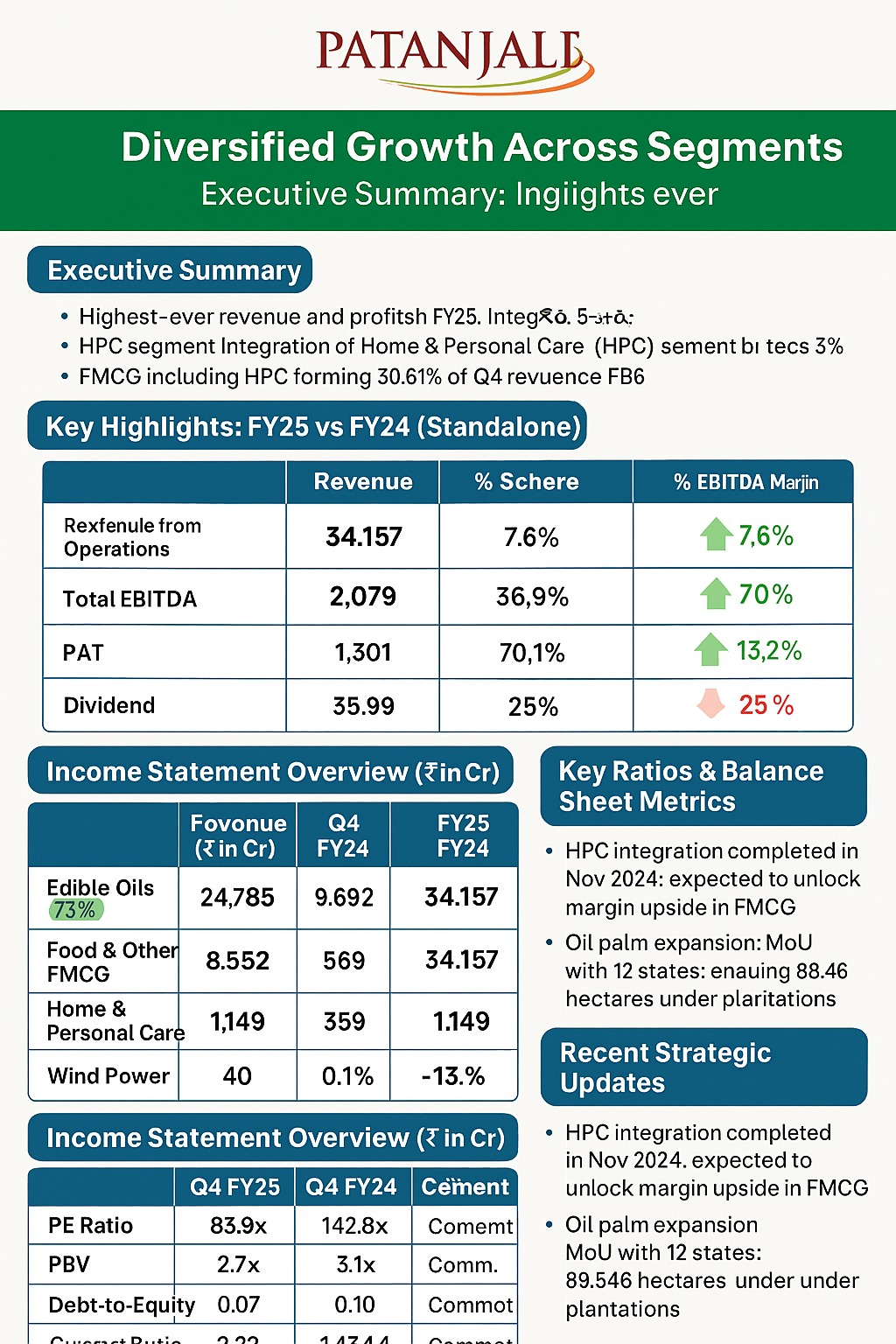

Patanjali Foods Ltd. reported its highest-ever revenue and profit in FY25, boosted by strong performances across Edible Oils, Food & FMCG, and the newly integrated Home & Personal Care (HPC) vertical. Strategic expansion and branding focus led to margin improvement despite a moderate operating environment.

Fair value:

📊 Key Financial Highlights – FY25 vs FY24 (Standalone)

Metric FY25 (₹ Cr) FY24 (₹ Cr) YoY Growth Revenue from Operations 34,157 31,742 🟢 7.6% Total EBITDA 2,079 1,519 🟢 36.9% Profit After Tax (PAT) 1,301 765 🟢 70.1% EPS (₹) 35.99 21.14 🟢 70.2% Dividend (FY25 Total) ₹10/share ₹8/share 🟢 25% up

| Metric | FY25 (₹ Cr) | FY24 (₹ Cr) | YoY Growth |

|---|---|---|---|

| Revenue from Operations | 34,157 | 31,742 | 🟢 7.6% |

| Total EBITDA | 2,079 | 1,519 | 🟢 36.9% |

| Profit After Tax (PAT) | 1,301 | 765 | 🟢 70.1% |

| EPS (₹) | 35.99 | 21.14 | 🟢 70.2% |

| Dividend (FY25 Total) | ₹10/share | ₹8/share | 🟢 25% up |

🧮 Valuation Ratios (at CMP ₹1775)

Ratio FY25 FY24 Change PE Ratio (CMP ₹1775) ~49.3x ~83.9x 🔽 Better PBV Ratio (BV ₹313) ~5.67x ~6.6x 🔽 Slight fall Debt-to-Equity 0.07 0.10 🟢 Very Low Current Ratio 2.29 2.56 🟢 Healthy

| Ratio | FY25 | FY24 | Change |

|---|---|---|---|

| PE Ratio (CMP ₹1775) | ~49.3x | ~83.9x | 🔽 Better |

| PBV Ratio (BV ₹313) | ~5.67x | ~6.6x | 🔽 Slight fall |

| Debt-to-Equity | 0.07 | 0.10 | 🟢 Very Low |

| Current Ratio | 2.29 | 2.56 | 🟢 Healthy |

🔍 Segment-Wise Performance – FY25

Segment Revenue ₹ Cr EBITDA ₹ Cr EBITDA Margin Share of Revenue Edible Oils 24,785.31 978.15 3.95% 72.5% Food & Other FMCG 8,552.20 672.93 7.87% 25.0% Home & Personal Care 1,148.85 152.14 13.2% 3.4% Wind Power 40.36 (13.25) Negative <0.2%

| Segment | Revenue ₹ Cr | EBITDA ₹ Cr | EBITDA Margin | Share of Revenue |

|---|---|---|---|---|

| Edible Oils | 24,785.31 | 978.15 | 3.95% | 72.5% |

| Food & Other FMCG | 8,552.20 | 672.93 | 7.87% | 25.0% |

| Home & Personal Care | 1,148.85 | 152.14 | 13.2% | 3.4% |

| Wind Power | 40.36 | (13.25) | Negative | <0.2% |

📌 Combined FMCG share in Q4 stood at 30.61% of revenue.

📦 Key Product & Volume Growth

Doodh Biscuits: Crossed ₹1,000 Cr in FY25

Biscuits & Confectionery: ₹1,677 Cr

Textured Soya Protein (TSP): ₹102.83 Cr in Q4

Dental Care (HPC): ₹398 Cr

Exports: ₹73.4 Cr in Q4; footprint in 29 countries

Doodh Biscuits: Crossed ₹1,000 Cr in FY25

Biscuits & Confectionery: ₹1,677 Cr

Textured Soya Protein (TSP): ₹102.83 Cr in Q4

Dental Care (HPC): ₹398 Cr

Exports: ₹73.4 Cr in Q4; footprint in 29 countries

📈 Income Statement Snapshot (₹ Cr)

Particulars Q4 FY25 Q4 FY24 FY25 FY24 Revenue from Operations 9,692 8,228 34,157 31,742 EBITDA 569 497 2,079 1,519 PAT 359 206 1,301 765 EPS (₹) 9.91 5.70 35.99 21.14

| Particulars | Q4 FY25 | Q4 FY24 | FY25 | FY24 |

|---|---|---|---|---|

| Revenue from Operations | 9,692 | 8,228 | 34,157 | 31,742 |

| EBITDA | 569 | 497 | 2,079 | 1,519 |

| PAT | 359 | 206 | 1,301 | 765 |

| EPS (₹) | 9.91 | 5.70 | 35.99 | 21.14 |

💰 Cash Flow Summary (₹ Cr)

Type of Cash Flow FY25 FY24 Cash from Operations 198 1,746 Cash from Investing (36) (912) Cash from Financing (611) (1,100) Net Cash Flow (449) (266) FCF (Post CapEx approx.) ₹160 Cr ₹820 Cr

| Type of Cash Flow | FY25 | FY24 |

|---|---|---|

| Cash from Operations | 198 | 1,746 |

| Cash from Investing | (36) | (912) |

| Cash from Financing | (611) | (1,100) |

| Net Cash Flow | (449) | (266) |

| FCF (Post CapEx approx.) | ₹160 Cr | ₹820 Cr |

🌱 Strategic Developments & Outlook

✅ Acquired HPC business from Patanjali Ayurved for ₹1,100 Cr

🛍️ Spent ₹325 Cr in Q4 for brand marketing

🌴 Signed MoUs with 12 states for Oil Palm Plantation (89,546 hectares)

🌐 Strengthened E-commerce, D2C & exports across 32 countries

📊 Rural FMCG demand outpaced urban demand in Q4

✅ Acquired HPC business from Patanjali Ayurved for ₹1,100 Cr

🛍️ Spent ₹325 Cr in Q4 for brand marketing

🌴 Signed MoUs with 12 states for Oil Palm Plantation (89,546 hectares)

🌐 Strengthened E-commerce, D2C & exports across 32 countries

📊 Rural FMCG demand outpaced urban demand in Q4

⚠️ Disclosures

🏛️ Legal Dispute: 1.86 Cr shares under High Court adjudication

💡 Dividend: ₹10/share (₹8 interim + ₹2 final), subject to AGM approval

🔄 Segment Realignment: HPC reported separately since Nov 2024

🏛️ Legal Dispute: 1.86 Cr shares under High Court adjudication

💡 Dividend: ₹10/share (₹8 interim + ₹2 final), subject to AGM approval

🔄 Segment Realignment: HPC reported separately since Nov 2024

📢 Disclaimer

This blog is intended for educational and informational purposes only. All financial data and analysis are based on publicly available information as of Q4 FY25, including the latest closing price (CMP ₹1775) at the time of writing. This content does not constitute investment advice, stock recommendations, or a solicitation to buy or sell securities. Investors must perform their own due diligenc