📊 Kajaria Ceramics Q4 FY25 Results Analysis 📈

💡 Recent Insights & Highlights

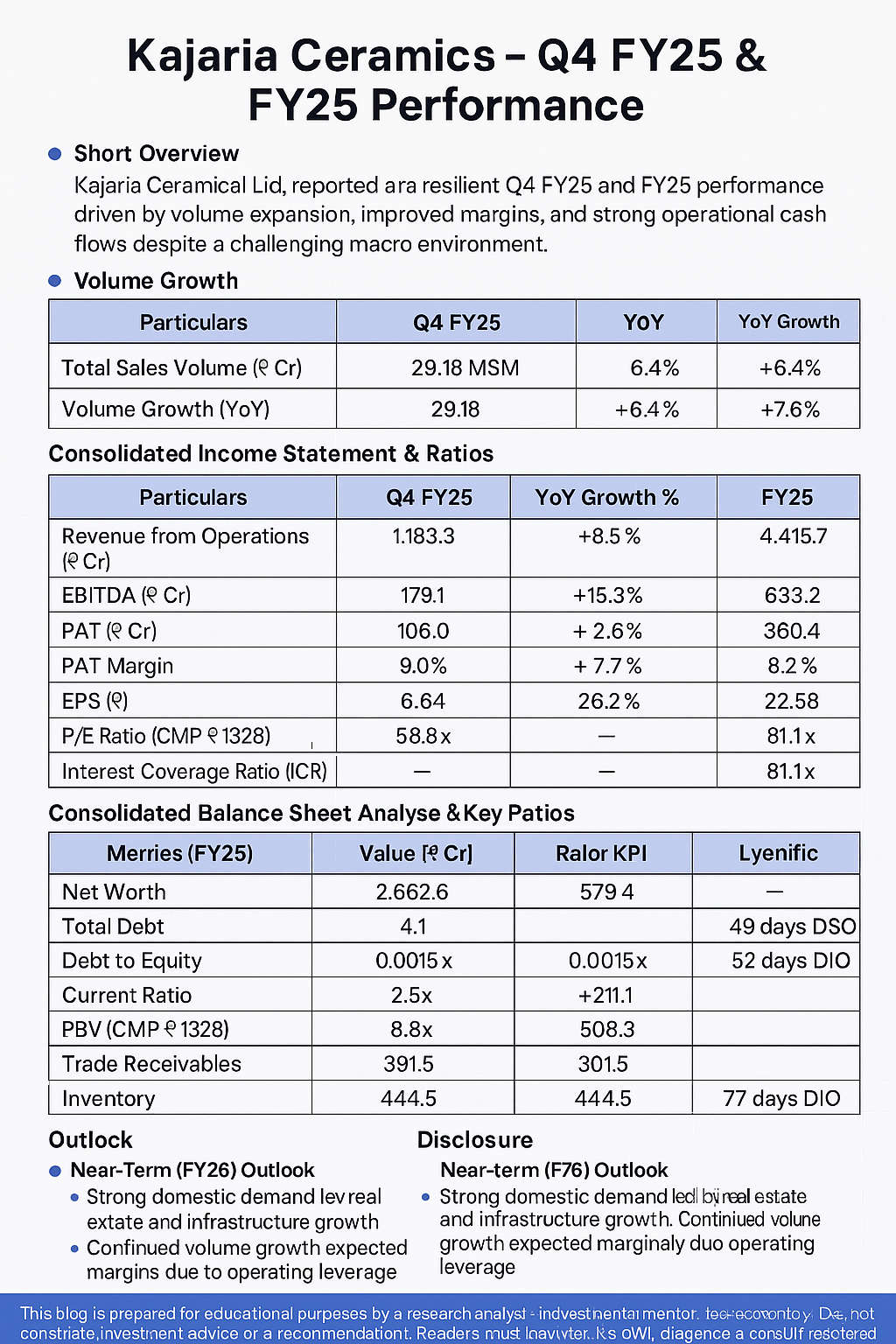

Soft demand 📉: 2% YoY tile volume growth in Q4, 6% in FY25 (115 MSM).

Margin pressure ⚖️: EBITDA margin fell to 10% in Q4 (vs 13.86% YoY) due to bathware losses, UK operations, and plywood provisions.

Profit decline 💸: Consolidated PAT dropped 58% YoY to ₹43 Cr in Q4; FY25 PAT fell 30% to ₹294 Cr.

Plywood exit 🚪: Discontinued operations led to ₹112 Cr exceptional loss in Q4.

📦 Volume Growth

📋 Consolidated Income Statement

📊 Key Ratios

Interest Coverage (ICR) 🏦: 13.46x (Q4), 19.03x (FY25)

PE Ratio (CMP ₹798) 📊: ~43.2x (based on FY25 EPS of ₹18.48)

📊 Consolidated Balance Sheet KPIs

💵 Consolidated Cash Flow Statement & Ratios

🔮 Near-Term & Short-Term Outlook

Cost optimization 🔧: Plans to streamline expenses to improve margins.

Expansions 🏭: Adhesive plant in Gailpur (operational by June 2025).

Subsidiaries 🏢: Bathware expected to turn profitable in FY26; UK operations scaled down.

📢 Disclosure: Forward-looking statements involve risks like demand fluctuations and operational challenges1.

All data sourced from Kajaria Ceramics’ Investor Release (May 6, 2025).