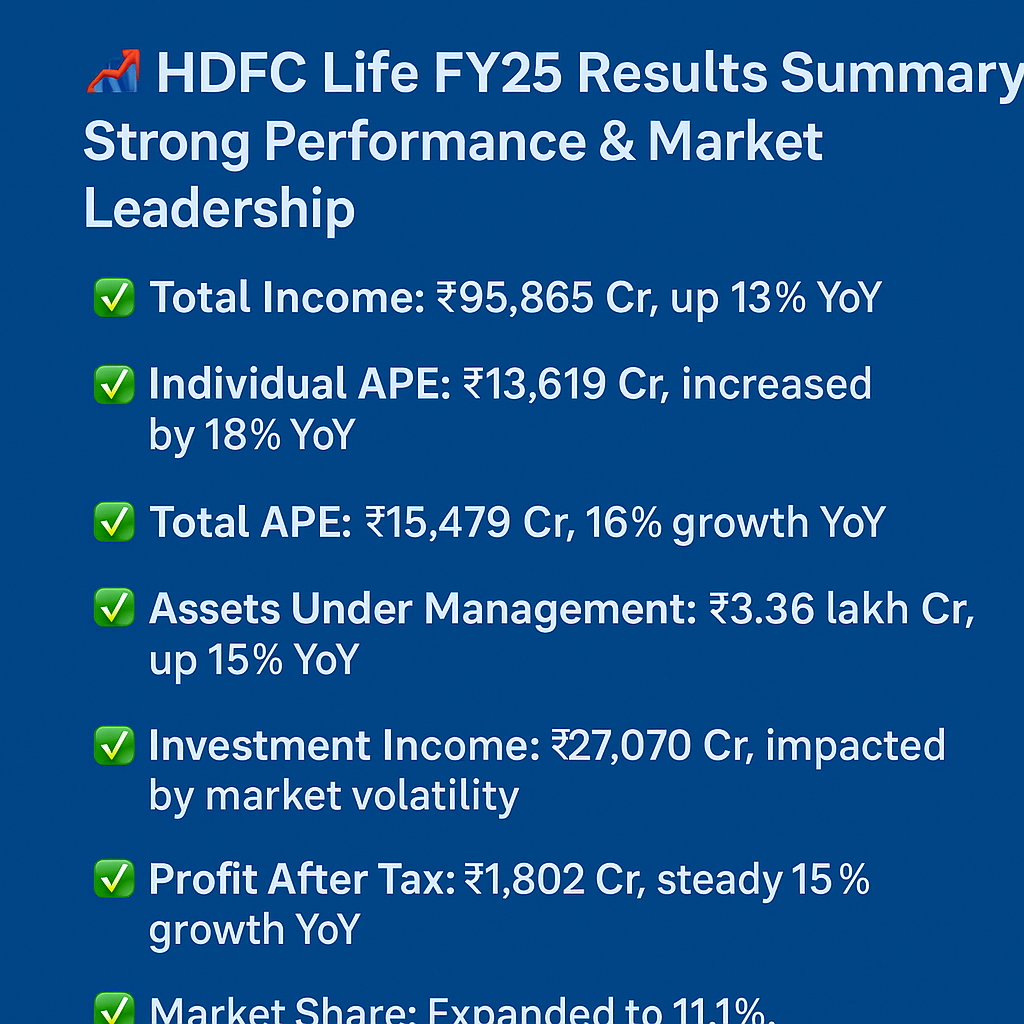

📈 HDFC Life FY25 Results: Strong Growth, Steady Profits & Enhanced Market Position

🚀 Financial Highlights:

Total Income Growth:

FY25: ₹95,865 Cr, up 13% YoY 📊

Q4FY25: ₹24,167 Cr, stable performance 🔍

Annual Premium Equivalent (APE) Growth:

Individual APE grew robustly at 18% YoY (₹13,619 Cr) 🆙

Total APE up 16% at ₹15,479 Cr 🚀

Assets Under Management (AUM):

₹3.36 lakh Cr, an impressive 15% growth YoY 🏦📈

Investment Income Growth:

FY25: ₹27,070 Cr, lower vs ₹39,354 Cr last year due to market volatility 📉

Q4FY25: ₹347 Cr, significantly down reflecting Q4 market pressures ⚠️

💰 Profitability & Margins:

Profit After Tax (PAT):

FY25: ₹1,802 Cr (+15% YoY) 📌

Q4FY25: ₹477 Cr (+16% YoY), showcasing strong quarterly performance ✅

Profit Margin:

Stable and consistent margins at ~2.5% for FY25, demonstrating resilience despite market headwinds 📌

Value of New Business (VNB):

Increased by 13% YoY to ₹3,962 Cr, indicating robust business quality 📊💎

New Business Margin at 25.6%, slightly down vs 26.3% last year, but still strong 🌟

🌐 Market Share & Industry Performance:

Market Share:

Overall market share improved by 70 bps to 11.1% 📌

Private sector share rose 30 bps to 15.7%, reaffirming leadership 🌟

Persistency Ratios:

13th Month Persistency: Strong at 87% 💪

Significant improvement in 61st-month persistency by 1000 bps (63%), highlighting excellent customer retention 🤝✨

📊 Key Industry KPIs (Year-over-Year Comparison):

⚖️ Valuation & Stock Metrics (at CMP ₹720):

Embedded Value (EV): ₹55,423 Cr, up 17% YoY 📈

Dividend: ₹2.1 per share proposed for FY25 💵🎯

🎯 Management’s Commentary:

🗣️ "FY25 was a remarkable year where we deepened market reach and strengthened our competitive edge, delivering robust 18% growth in Individual APE. Our long-term aim remains to consistently outperform industry growth, enhance profitability, and double key metrics every 4-4.5 years." – Vibha Padalkar, MD & CEO

🔮 Near-Term & Long-Term Outlook:

Near-Term: Positive trajectory with continued premium and AUM growth; market volatility could affect short-term investment income 🌤️

Long-Term: Strategic initiatives focused on increasing digital distribution, strengthening market share, and consistent growth in embedded value 🌞📅

📌 Investor Takeaways:

✅ Solid growth across all key metrics despite market volatility

✅ Improved market position and persistency highlighting strong management

✅ Healthy dividend payouts with stable profitability

📝 Disclaimer:

The content presented is solely for informational purposes and should not be considered investment advice. Investors must conduct their own due diligence before making investment decisions.