📊 Eternal Limited – Q4FY25 & FY25 Financial and Strategic Performance Update

CMP: ₹232

Industry: Online Services / Quick Commerce / Food Delivery

Formerly Known As: Zomato Limited

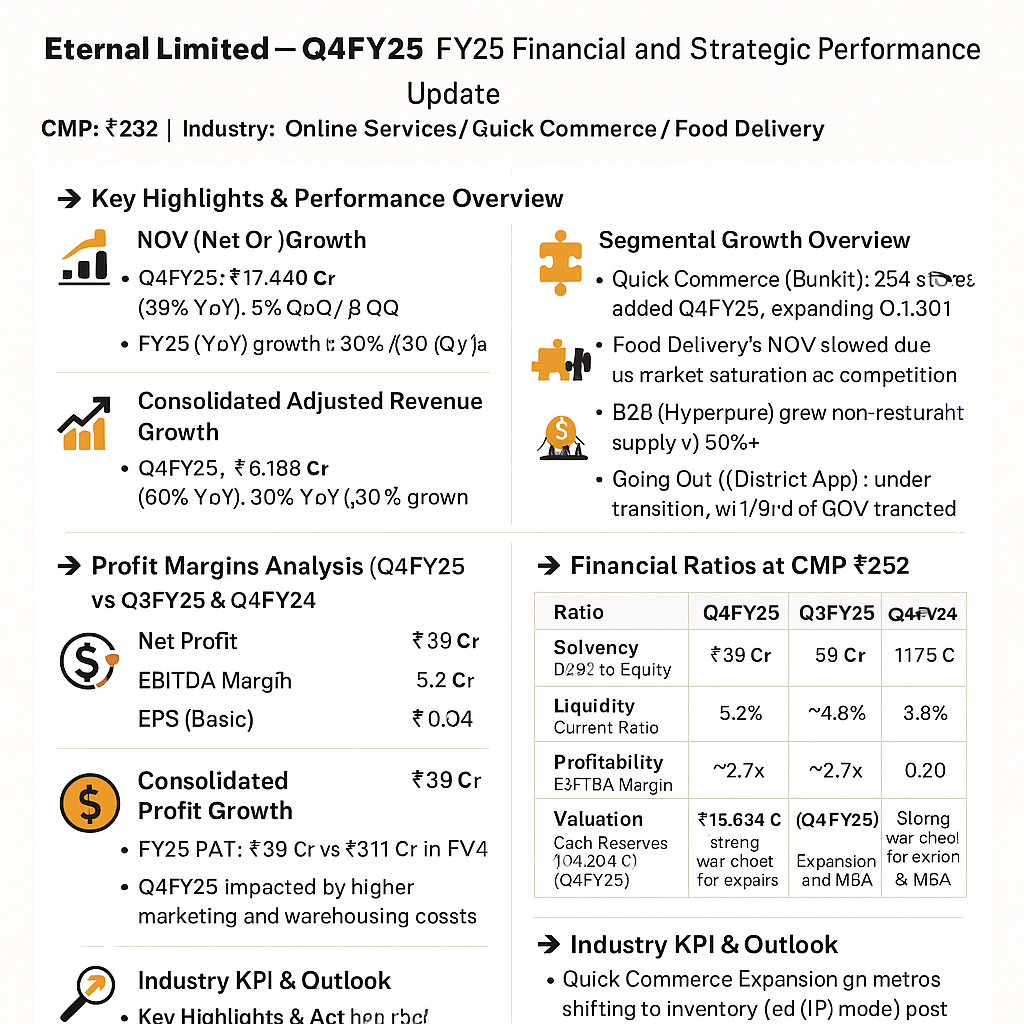

🔍 Key Highlights & Performance Overview

🧾 NOV (Net Order Value) Growth

Q4FY25: ₹17,440 Cr — 53% YoY, 5% QoQ

FY25 (like-for-like): ~48% YoY growth

Transitioned from GOV to NOV for improved realism in revenue estimation (excluding inflated MRP).

💰 Consolidated Adjusted Revenue Growth

Q4FY25: ₹6,188 Cr — 60% YoY, 8% QoQ

FY25 (Reported): ₹8,617 Cr vs ₹6,622 Cr in FY24 — 30% YoY growth

🧩 Segmental Growth Overview

Quick Commerce (Blinkit): Added 294 new stores in Q4FY25; store network expanded to 1,301. Revenue & NOV rose significantly.

Hyperpure (B2B): Revenue grew 93% YoY in Q4FY25; non-restaurant B2B business grew 150%+ YoY.

Food Delivery: Slower NOV growth due to market saturation, competition, and delisting of ~19,000 low-compliance restaurants.

Going Out (District App): Under transition; ~1/3rd of GOV now transacted through it

📈 Profit Margins Analysis (Q4FY25 vs Q3FY25 & Q4FY24)

📉 Consolidated Profit Growth

FY25 PAT: ₹527 Cr vs ₹351 Cr in FY24 — 50%+ YoY growth

Q4FY25 PAT: ₹39 Cr — impacted by higher marketing & warehousing costs

🧮 Financial Ratios at CMP ₹232

🌐 Industry KPI & Outlook

Quick Commerce Expansion: Blinkit growing aggressively in metros; shifting to inventory-led (1P) model post IOCC status.

Food Delivery Challenges: Saturation, price wars, and competition from packaged foods via Q-commerce.

B2B Potential: Hyperpure’s non-restaurant supply scaling rapidly, targeting 4-hour delivery and logistics solutions.

New Metric (NOV): More realistic consumption metric considering Indian MRP anomalies — gaining relevance over GOV.

🔮 Strategic Outlook

🔸 Near-Term:

Margin pressure likely to persist due to aggressive investments.

Store and customer acquisition focus over short-term profits.

Regulatory clarity around inventory ownership awaited.

🔹 Long-Term:

Strong prospects in quick commerce with scalable warehousing.

Food delivery to rebound with leadership reshuffle and focus on trust.

Hyperpure to evolve as a logistics-tech B2B platform across cities.

⚠️ Disclosure & Risks

Company faces GST litigation over delivery charges (₹420 Cr demand).

Short-term profitability sacrificed for expansion amid intense competition.

NOV shift may take time for market participants to digest and adopt fully.

✅ Verdict

Eternal is aggressively positioning itself for long-term leadership in India’s consumption economy. While FY25 saw heavy investment and margin compression, the platform’s scale, NOV-led transparency, and war chest of over ₹18,000 Cr bolster investor confidence. Strategic reorientation, especially in quick commerce and B2B, suggests multi-year runway — ideal for long-term investors with high-risk appetite.