🧾 DMart Q4 FY25 & FY25 Result Highlights – Resilient Growth Amid Operational Pressures

📌 Key Performance Highlights

✅ Like-to-Like (LTL) Growth – Q4 FY25

Estimated LTL revenue growth stands moderately positive as store additions continue to weigh, indicating robust demand in mature clusters while new stores stabilize.

Growth compared to Q4 FY24 (₹12,726.55 Cr) to Q4 FY25 (₹14,871.86 Cr): ~16.9% YoY growth in consolidated revenue suggests moderate LTL expansion.

✅ Consolidated Sales Growth

🏬 Store Network Growth

Continued capex and higher inventories (₹5,044 Cr vs ₹3,927 Cr) signal expansion in physical retail footprint.

Online channels via Avenue E-commerce also contributed modestly to topline.

📊 Profitability Overview

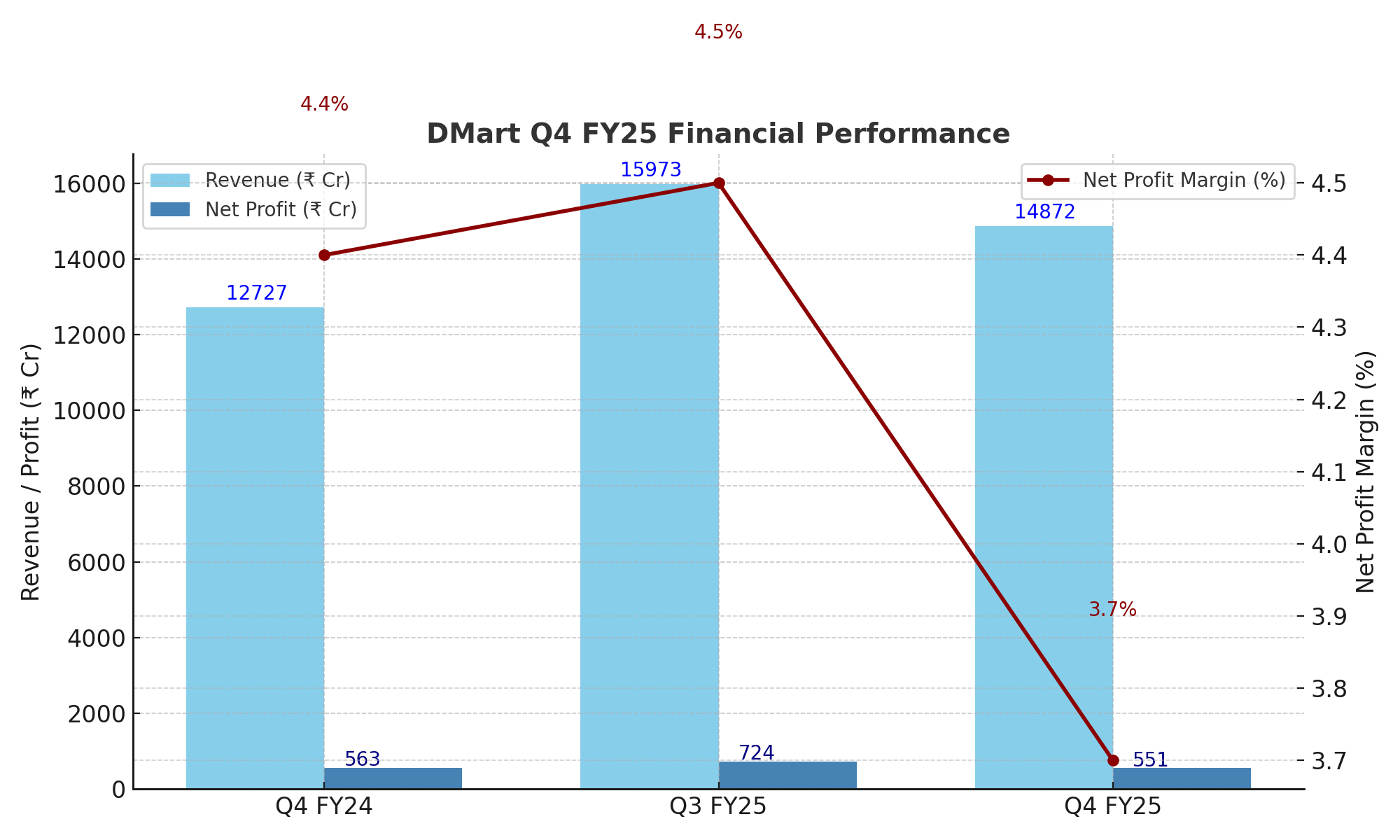

✅ Net Profit Growth

Q4 saw margin compression owing to inventory adjustments and muted festive spillover vs Q3.

✅ Profit Margins

*Margins impacted by higher Opex and backend logistics costs.

💼 Financial Ratios @ CMP ₹4,060

📈 Cashflow and Capex Trends

Cash Flow from Operations (FY25): ₹2,462.97 Cr (↓ from ₹2,745.84 Cr)

Capex: ₹3,423.04 Cr – major store and backend infra expansion

Despite cash outflows, the company maintained healthy cash & equivalents of ₹355.48 Cr

🧭 Industry KPIs & Macro Trends

🔮 Outlook – Strategic Perspective

⏳ Near-Term Outlook (FY26)

Cautious optimism expected as operational leverage stabilizes.

Focus on enhancing productivity per store & e-commerce efficiency.

🌐 Long-Term Outlook (FY25–FY30)

Structural story intact: value retail model, deep supply chain, cost focus.

Earnings CAGR expected at 14–16% with margin normalization and network expansion.

Potential PE re-rating unlikely due to high base; growth-led returns more probable.

⚠️ Disclosure

This analysis is intended for educational purposes only. Investors are advised to perform their own due diligence before making investment decisions.