ICICI Lombard General Insurance Q1 FY26 Results Analysis: Stable Growth Amid Regulatory Changes

ICICI Lombard Q1 FY26 Results: Detailed financial analysis, segment growth, industry KPIs, profit margins, solvency, and investor outlook. Read for key insights, tables, and actionable conclusions.

1. Recent Insights & Management Highlights

Regulatory Update: From Oct 1, 2024, long-term insurance products are accounted for on a 1/n basis (per IRDAI). This impacts YoY comparability for premium income and ratios.

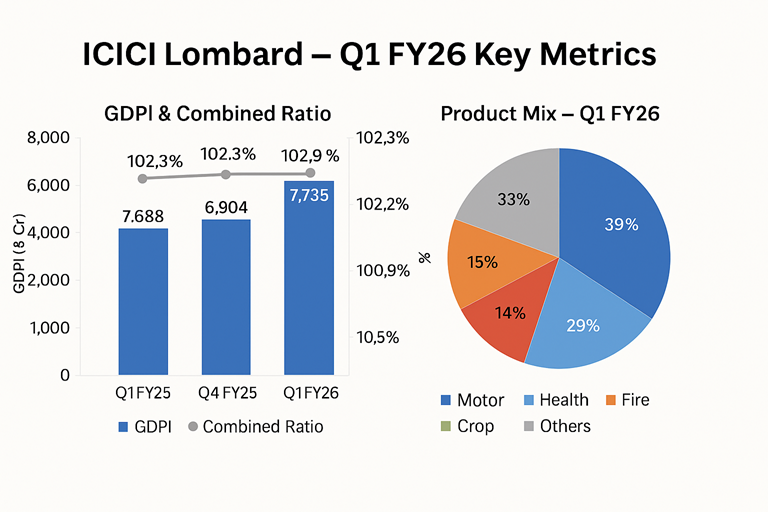

Premium Income: Gross Direct Premium Income (GDPI) stood at ₹77.35 billion (Q1 FY26), up just 0.6% YoY due to accounting changes. Excluding this, underlying GDPI growth was a healthy 4.8%.

Profit Growth: PAT rose sharply by 28.7% YoY to ₹7.47 billion; PBT grew 28.4% to ₹9.94 billion.

Operational Performance: Combined Ratio remained stable at 102.9% (vs 102.3% last year). Return on Average Equity improved to 20.5%.

Strategic Developments:

Continued tech adoption (AI, ML, cloud migration).

Expanded digital product delivery and enhanced rural/SME reach.

Maintained industry-leading solvency at 2.70x (well above 1.50x minimum).

2. Consolidated Financial Analysis

a) Income Statement Highlights

Note: All data adjusted for regulatory accounting changes as per IRDAI. Source: Q1 FY26 Results.

b) Growth Rates & Margins

3. Profitability & Growth Ratios

P/E Calculation: CMP ₹2001 ÷ EPS ₹54.03 (FY25 trailing) = ~37x

4. Key Industry KPIs

*Industry average growth is for general insurance; sources: IRDAI, Company Data.

5. Near-Term & Long-Term Outlook

Near-Term (Next 1-2 Quarters)

Expect premium growth to gradually normalize as the impact of the 1/n accounting fades.

Profitability metrics likely to remain stable, given robust investment income and controlled claims.

Continued focus on digital distribution, AI-based claims, and Tier-3/4 expansion.

Long-Term (5+ Years)

General Insurance industry remains structurally underpenetrated (non-life insurance density far below global average).

Regulatory tailwinds (IRDAI reforms), digital adoption, and new product lines to drive steady premium and profit growth.

ICICI Lombard, as a market leader with strong solvency and tech-led operations, is well placed for long-term value creation.

6. Conclusion for Long-Term Investors

Key Positives

Consistent market leadership (top private insurer, 9.8% share).

Resilient profitability with rising ROE and stable combined ratio.

Tech-enabled growth and digital distribution expansion.

Strong solvency (2.7x) ensures risk coverage and capital flexibility.

Segment strength: Rapid growth in retail health, steady motor and fire lines.

Potential Risks

Industry growth lagged in Q1 due to regulatory/accounting change—watch for further regulatory interventions.

Competitive pressure in motor and group health segments.

Catastrophic events can impact claims and profitability, although risk is well diversified.

Investment Stance

Cautiously Optimistic – Suitable for Core Portfolio.

Valuations are slightly rich (P/E ~37x), but justified for a sector leader with stable long-term prospects. Watch for premium growth recovery and margin sustainability.

7. Disclosure

This analysis is provided solely for informational purposes and does not constitute investment advice. Investors should perform their own due diligence before making investment decisions.