L&T Technology Services Ltd (LTTS) Q1 FY26 Results: Investor Analysis

1. Recent Insights & Management Commentary

Strong Start to FY26:

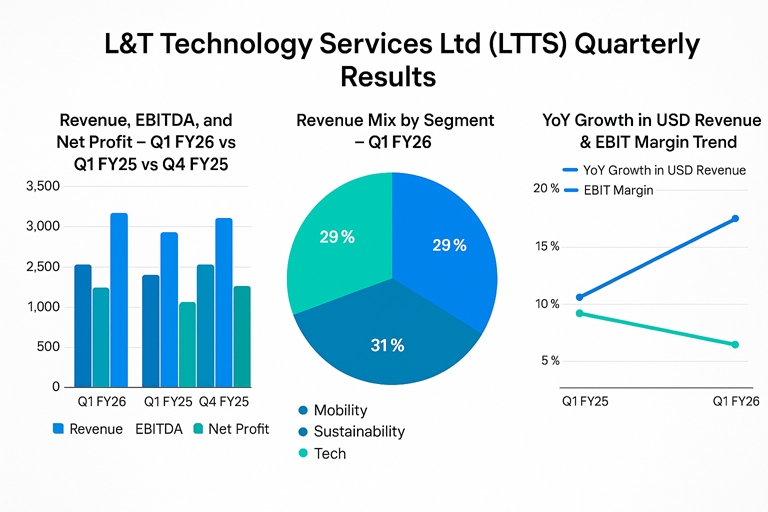

LTTS began FY26 with robust momentum in large deals, continuing its USD 200+ Mn TCV streak for the third consecutive quarter.Q1 Highlights:

Revenue: ₹2,866 crore (+16.4% YoY, -3.9% QoQ)

Net Profit: ₹316 crore (+0.7% YoY, +1.5% QoQ)

EBIT Margin: 13.3% (improved sequentially)

USD Revenue: $335.3 million (+13.6% YoY)

Strategic Developments:

Announced major wins in Sustainability, Mobility, and Tech segments.

Opened a new Design Center in Plano, Texas, focused on AI, cybersecurity, and advanced tech.

Launched “PLxAI” – proprietary AI framework, now scaled across verticals.

Continued to invest in R&D with 206 AI patents filed in Q1; total patent portfolio at 1,550.

2. Consolidated Financial Analysis

Income Statement (₹ Million)

Margins

Segmental & Regional Revenue (₹ Million)

Regional Revenue Mix (% of Total)

3. Profitability, Growth & Valuation Ratios (at CMP ₹4,345)

EPS (Q1 FY26, Diluted): ₹29.77

TTM EPS: Approx. ₹119.44P/E Ratio: 36.4x

(= CMP ₹4345 / TTM EPS ₹119.44)Return on Equity (ROE):

Last FY: Approx. 20.9% (Net profit / Equity as per annual data)Return on Capital Employed (ROCE):

Last FY: ~26.7% (as per annual data)

4. Industry-Specific KPIs (Engineering & Technology)

Other Key Data:

Large Deals: 1 deal >$50M, 3 deals $20–30M, 6 deals >$10M.

Active Clients: 459 (+81 YoY)

Patents: 1,550 (206 new AI-related in Q1)

Headcount: 23,626

5. Outlook – Near-Term & Long-Term

Near-Term (1–2 Quarters)

Guidance:

Management expects double-digit revenue growth for FY26.

EBIT margins likely to improve as growth becomes broad-based.

Continued focus on large deal wins, client diversification, and margin expansion.

Industry Trend:

Resilient demand for ER&D and digital transformation, but mobility segment could remain volatile due to macro headwinds.

Long-Term

Strategic Growth Areas:

Investment in AI (PLxAI), digital engineering, and sustainability solutions.

Expansion in North America & Europe with specialized design centers.

Robust patent portfolio enhances IP-driven revenues.

Focus on high-value, long-term contracts (TCV above $200M+ per quarter).

6. Conclusion for Long-Term Investors

Key Positives

Consistent large deal wins and strong client pipeline.

High-quality, diversified revenue base (by segment and geography).

Strong balance sheet and cash position.

Leadership in digital engineering, AI, and sustainability.

Key Risks

Macroeconomic uncertainties may impact short-term segmental growth.

Slight sequential decline in topline due to seasonality and Tech segment slowdown.

Attrition at 14.8% (needs to be monitored; industry average).

Investment Stance:

Cautiously Optimistic – LTTS remains a solid long-term play on global ER&D outsourcing and digital transformation, with differentiated capabilities in AI and sustainability. Valuations remain elevated; investors may consider accumulating on dips.

7. Disclosure

This analysis is provided solely for informational purposes and does not constitute investment advice. Investors should perform their own due diligence before making investment decisions.