HDFC Bank Q1 FY26 Results: Growth Resilient, Bonus Announced! 🚀🏦

Current Market Price (CMP): ₹1,957

1. Recent Insights & Key Highlights

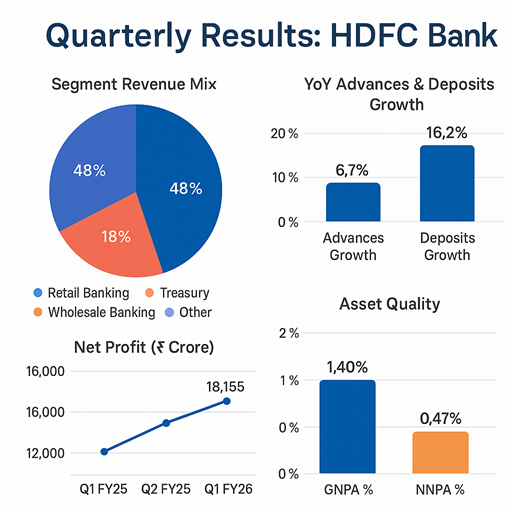

Net Profit: ₹18,155 Cr (+12.2% YoY)

Net Revenue: ₹53,170 Cr (+31.2% YoY, includes ₹9,128 Cr gain from HDB Financial Services IPO divestment)

Advances: ₹26,28430 Cr (+6.7% YoY)

Deposits: ₹27,64,090 Cr (+16.2% YoY)

Gross NPA: 1.40% (Stable asset quality)

Special Interim Dividend: ₹5/share (pre-bonus)

Bonus Issue: 1:1 (1 bonus share for each share held, subject to approvals)

"Despite sectoral challenges and a high base, HDFC Bank delivered steady growth in profits, advances, and deposits while maintaining robust asset quality and capital adequacy." 🌱

2. Consolidated Financial Analysis

Income Statement Highlights (₹ in Cr)

Note: Net Profit includes gains from HDB Financial divestment. Core margins remain robust despite pressure from rising deposit costs.

Segmental Revenue (₹ Cr)

Regional Performance

Branch Network: 9,499 branches, 21,251 ATMs across 4,153 cities/towns

51% of branches in semi-urban & rural areas—deepening financial inclusion.

Profit Margins (%)

3. Profitability, Growth & Valuation Ratios

📊 Valuations remain attractive given growth and asset quality stability.

4. Key Performance Indicators (KPIs) for Banking Sector

5. Near-Term & Long-Term Outlook 🔮

Near-Term (Next 1–2 Quarters)

Focus on digital expansion, deeper rural reach, and sustained asset quality.

Margin pressure may persist as deposit costs rise.

Integration and monetization of subsidiaries (HDB Financial, HDFC Life, HDFC AMC) will continue to support earnings.

Long-Term

India’s economic momentum, increasing credit penetration, and large branch network position HDFC Bank for market share gains.

Asset quality and robust capital position allow for growth despite regulatory or economic headwinds.

Bonus share issuance and consistent dividend payouts reflect management’s confidence in future prospects.

6. Conclusion for Long-Term Investors 🏆

Key Positives:

Consistent profit & balance sheet growth 🚀

Strong asset quality with low NPAs 🔒

Leadership in retail & digital banking 📱

Attractive bonus and dividend policy 💸

Potential Risks:

Margin compression if deposit costs rise further

Competitive intensity in retail loans

Regulatory changes

Investment Stance:

Cautiously Optimistic – HOLD for long-term compounding. Investors may consider accumulating on declines for wealth creation, given the bank’s strong fundamentals and future growth drivers.

7. Disclosure

This analysis is provided solely for informational purposes and does not constitute investment advice. Investors should perform their own due diligence before making investment decisions.